- PL Capital expects a strong pick-up in domestic demand, supported by benign inflation (CPI at 1.6% with food deflation); demand likely to sustain beyond the festival season

- Expects Nifty to reach 27,609 in the next 12 months

Mumbai, August 2025: PL Capital, one of India’s most trusted financial services organizations, in its latest India Strategy Report titled “Ready for next leg of growth”, highlighted that the conditions are ripe for a strong boost in domestic demand, driven by multiple tailwinds, that are likely to sustain beyond the festive season. Lower inflation (CPI at 1.6% with food deflation), normal monsoons boosting rural incomes, and a fiscal boost from ₹1,000 bn tax cuts in FY26 are laying the foundation for this recovery. The momentum is expected to strengthen further in 2H26 with the transmission of RBI’s 100 bps rate cuts, lowering EMIs and stimulating demand for housing, automobiles, and personal loans. Complementing this, GST 2.0 reforms—which rationalize tax slabs and reduce prices across automobiles, durables, staples, and medicines—are poised to trigger broad-based consumption. The report emphasizes that reviving consumption demand is critical to sustaining India’s growth trajectory. Under the vision for ‘Atamnirbhar Bharat’, with a focus on GST reforms, defence initiatives, support to agriculture, youth employment and energy security, the current US tariff challenge can be turned into a big opportunity.

Indian markets have displayed notable resilience

The report highlights that Indian markets have displayed notable resilience, maintaining a largely flat trend since early July despite penal tariffs from the US and FII outflows of ₹410 bn. Corporate earnings have been reasonable, with sales, EBITDA, and PAT broadly in line with expectations, deviating by just 2%, 0.9%, and -0.5% respectively. However, the fragile geopolitical environment and continued US tariff actions pose risks to global trade and GDP growth, as the full impact of higher import duties unfolds.

NIFTY EPS estimates have been revised by -1.4%/-0.4% for FY26/27, though earnings are still projected to grow at a healthy 13.2% CAGR over FY25-27, with EPS expected at ₹1,254/1,445. At present, NIFTY trades at 18.9x one-year forward EPS, a marginal 1% discount to its 15/10-year average PE of 19.1x. Applying the 15-year average PE of 19.1x to March’27 EPS of ₹1,445, we derive a 12-month NIFTY target of 27,609 (versus 26,889 earlier at 18.6x FY27 EPS).Structural themes such as defence, infrastructure, EMS, hospitals, and power transmission remain intact, albeit with limited scope for further re-rating.

GST 2.0: lower prices to boost demand

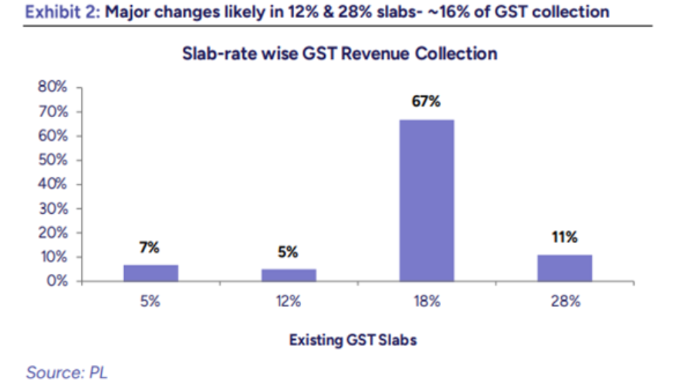

Implemented on 1 July 2017, the Goods and Services Tax (GST) stands as India’s most significant tax reform, unifying multiple indirect taxes under a single framework. It has since become the largest contributor to indirect tax revenue for both the Centre and the states, with collections rising consistently from ₹11,770 bn in FY2018–19 to a record ₹22,080 bn in FY2024–25. The Government of India is preparing to roll out GST 2.0, the next phase of tax reform focused primarily on rate rationalization. The proposal aims to reduce the existing four GST slabs (5%, 12%, 18%, and 28%) to mainly two—5% and 18%. As part of this restructuring, the 12% and 28% slabs will be eliminated, with most items currently taxed at 12% shifting down to 5% and a few moving up to 18%. Similarly, most non-luxury items under the 28% bracket will move to 18%, while only a limited set of goods may be adjusted higher or lower depending on their classification as luxury or essential.

The most significant changes will come from the 12% and 28% slabs, which together contribute about 16% of GST collections, while the 18% slab—accounting for 67% of revenues—will remain untouched. Notably, items such as petrol, diesel, liquor, and electricity are unlikely to be brought under GST 2.0. Overall, this restructuring is expected to simplify the tax system, reduce classification disputes, and boost consumption by easing the tax burden on several everyday goods.

Model Portfolio

PL Capital maintains an overweight stance on Banks, Healthcare, Consumer, Telecom, Auto, and Capital Goods, while remaining underweight on IT Services and Commodities. PL Capital expects a revival in domestic consumption and has accordingly raised weights in Automobiles and Consumer, while trimming exposure to Capital Goods, Healthcare, and Banks—though these sectors continue to remain overweight.