- Price Band of ₹30 – ₹32 per equity share bearing face value of ₹10 each (“Equity Shares”)

- Bid/Offer Opening Date – Tuesday, November 21, 2023 and Bid/Offer Closing Date – Thursday, November 23, 2023.

- Minimum Bid Lot is 460 Equity Shares and in multiples of 460 Equity Shares thereafter.

- The Floor Price is 3.00 times the face value of the Equity Share and the Cap Price is 3.20 times the face value of the Equity Share.

Chennai, November 18, 2023: Indian Renewable Energy Development Agency Limited, a Government of India (“GoI”) enterprise notified as a “Public Financial Institution” (“PFI”) registered as a Systemically Important Non-Deposit-taking Non-Banking Finance Company (a “NBFCND-SI”), with Infrastructure Finance Company (“IFC”) status, has fixed the price band at ₹30 to ₹32 per Equity Share for its maiden initial public offer. The Initial Public Offering (“IPO” or “Offer”) of the Company will open for public on Tuesday, November 21, 2023, for subscription and close on Thursday, November 23, 2023. Investors can bid for a minimum of 460 Equity Shares and in multiples of 460 Equity Shares thereafter.

The Offer comprises of fresh issuance of Equity Shares up to 403,164,706 equity shares and an Offer for Sale (OFS) of up to 268,776,471 equity shares aggregating to up to 671,941,177equity shares.

IREDA is a financial institution with over 36 years of experience in promoting, developing and extending financial assistance for new and renewable energy projects, and energy efficiency and conservation projects. It provides a comprehensive range of financial products and related services, from project conceptualisation to post-commissioning, for renewable energy projects and other value chain activities, such as equipment manufacturing and transmission.

It is also India’s largest pure-play green financing NBFC in India. IREDA is the issuer of first debt security (green masala bond) in India listed on IFSC exchange. IREDA is the first financial institution in India to raise green masala bonds IREDA is among the first financial institution to raise global funds for climate financing from DFIs / multilaterals in India.

It has a geographically diversified portfolio, with Term Loans Outstanding across 23 States and five Union Territories across India, as of September 30, 2023, and has four strategically located branches in Mumbai, Hyderabad, Chennai, and Bhubaneshwar to maximize geographical range in terms of territory.

IREDA also extends lines of credit to other non-banking financial companies (NBFCs) for lending to RE and EEC projects. Additionally, it offers loans to government entities and financing schemes for RE suppliers, manufacturers, and contractors, while non-fund-based products comprise instruments like letters of comfort, letters of undertaking, payment on order instruments, and guarantee assistance schemes. Furthermore, it provides consultancy services on techno-commercial issues related to the RE sector. As of September 30, 2023, it had a diversified portfolio of term loan outstanding amounting to Rs 475,144.8 million

For the fiscal year 2023, the net interest income increased to Rs 13,237.65 million against Rs 11,280.44 million a year ago. Net profit increased from Rs 6,335.28 million in fiscal 2022 to Rs 8,646.28 million in fiscal 2023. Capital to risk-weighted asset ratio (“CRAR”) stood at 18.82% for Fiscal 2023 and for the six months ended September 30, 2023, it was 20.92%.

For the six months ended September 30, 2023, Net Interest Income stood at Rs 7,854.23 million, and profit after tax was Rs 5,793.15 million. For the same period, IREDA sanctioned total loans amounting to Rs 47,445.03 million.

In case of any revision in the Price Band, the Bid/Offer Period will be extended by at least three additional Working Days after such revision in the Price Band, subject to the Bid/Offer Period not exceeding 10 Working Days. In cases of force majeure, banking strike or similar circumstances, our Company and the Promoter Selling Shareholder, in consultation of the BRLMs, may for reasons to be recorded in writing, extend the Bid/Offer Period for a minimum of three Working Days, subject to the Bid/Offer Period not exceeding 10 Working Days. Any revision in the Price Band and the revised Bid/Offer Period, if applicable, shall be widely disseminated by notification to the Stock Exchanges, by issuing a public notice, and also by indicating the change on the respective websites of the Book Running Lead Managers and at the terminals of the Syndicate Members and by intimation to Self-Certified Syndicate Banks (“SCSBs”), other Designated Intermediaries and the Sponsor Banks, as applicable.

The Offer is being made in terms of Rule 19(2)(b) of SCRR through the Book Building Process in accordance with Regulation 6(1) of the SEBI ICDR Regulations wherein not more than 50% of the Net Offer shall be available for allocation on a proportionate basis to QIBs, provided that our Company and the Promoter Selling Shareholder i.e. Government of India, in consultation with the Book Running Lead Managers, may allocate up to 60% of the QIB Portion to Anchor Investors on a discretionary basis in accordance with the SEBI ICDR Regulations, of which one-third shall be reserved for domestic Mutual Funds, subject to valid Bids being received from domestic Mutual Funds at or above the Anchor Investor Allocation Price. In the event of undersubscription, or non-allotment in the Anchor Investor Portion, the balance Equity Shares shall be added to the Net QIB Portion. Further, 5% of the Net QIB Portion shall be available for allocation on a proportionate basis only to Mutual Funds, subject to valid Bids being received at or above the Offer Price and the remainder of the Net QIB Portion shall be available for allocation on a proportionate basis to all QIBs (other than Anchor Investors), including Mutual Funds, subject to valid Bids being received at or above the Offer Price. Further, not less than 15% of the Net Offer shall be available for allocation to Non-Institutional Bidders out of which (a) one-third of such portion shall be reserved for Bidders with application size of more than ₹200,000 and up to ₹1,000,000; and (b) two-thirds of such portion shall be reserved for Bidders with application size of more than ₹1,000,000, provided that the unsubscribed portion in either of such sub-categories may be allocated to applicants in the other sub-category of Non-Institutional Bidders and not less than 35% of the Net Offer shall be available for allocation to RIBs in accordance with the SEBI ICDR Regulations, subject to valid Bids being received at or above the Offer Price.

Further, Equity Shares will be allocated on a proportionate basis to the Eligible Employees applying under the Employee Reservation Portion, subject to valid Bids received from them at or above the Offer Price. All potential Bidders (except Anchor Investors) are required to mandatorily utilise the Application Supported by Blocked Amount (“ASBA”) process providing details of their respective ASBA Accounts (as defined hereinafter), and UPI ID in case of UPI Bidders (as defined hereinafter) using the UPI Mechanism, if applicable, in which the corresponding Bid Amounts will be blocked by the SCSBs or under the UPI Mechanism, as the case may be, to the extent of respective Bid Amounts. Anchor Investors are not permitted to participate in the Offer through the ASBAprocess. For details, see “Offer Procedure” on page 626 of the RHP.

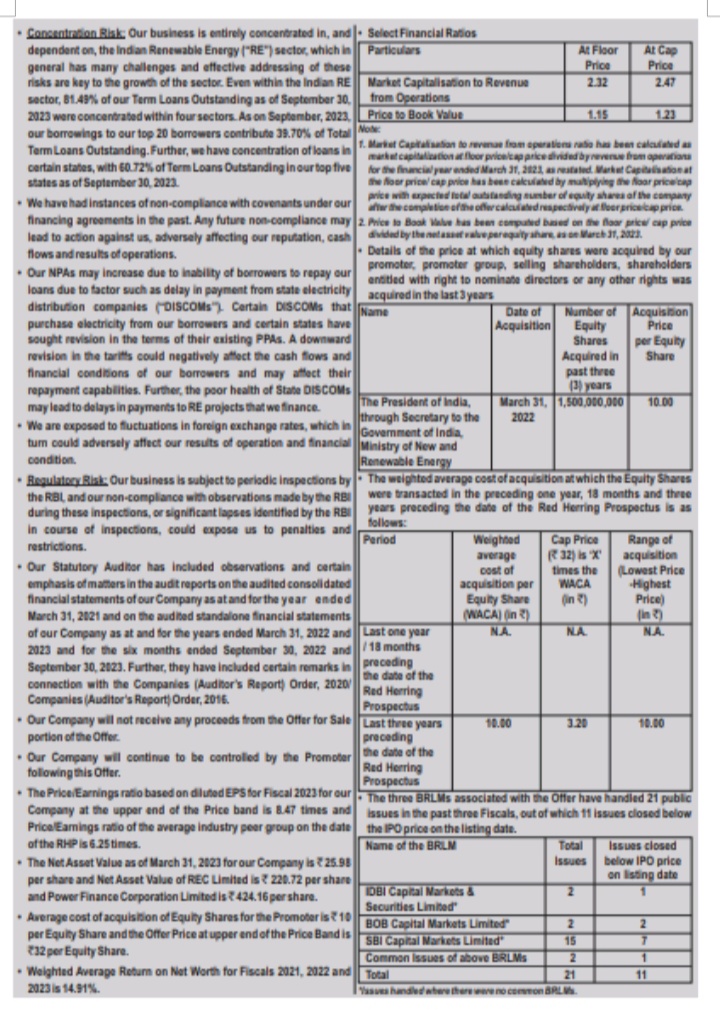

IDBI Capital Markets & Securities Limited, BOB Capital Markets Limited, and SBI Capital Markets Limited are the book-running lead managers and Link Intime India Private Limited is the registrar to the offer. The equity shares are proposed to be listed on BSE and NSE.

DISCLAIMERS: INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LIMITED is proposing, subject to receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its Equity Shares and has filed a draft red herring prospectus dated September 7, 2023 with SEBI (the “DRHP”) and a red herring prospectus dated November 11, 2023 (“RHP”) with the RoC. The RHP is made available on the website of the SEBI at www.sebi.gov.in as well as on the website of the BRLMs i.e., IDBI Capital Markets & Securities Limited at www.idbicapital.com, BOB Capital Markets Limited at www.bobcaps.in and SBI Capital Markets Limited at www.sbicaps.com, the website of the NSE at www.nseindia.com and the website of the BSE at www.bseindia.com and the website of the Company at www.ireda.in. Any potential investor should note that investment in equity shares involves a high degree of risk and for details relating to such risks, please see the section titled “Risk Factors” beginning on page 35 of the RHP. Potential investors should not rely on the DRHP for making any investment decision, but can only rely on the information included in the RHP.

The Equity Shares have not been and will not be registered under the Securities Act or any U.S. federal, state or other securities laws. The Equity Shares may not be transferred or resold except as permitted under the U.S. Securities Act, the applicable state securities laws and any applicable non-U.S. securities laws, pursuant to registration or exemption therefrom. The Company will not be registered as an investment company under the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”) and accordingly is not subject to the protections of the Investment Company Act. Accordingly, the Equity Shares are being offered and sold (a) to persons in the United States and to U.S. Persons who are both, (i) “qualified institutional buyers” (as defined in Rule 144A under the U.S. Securities Act and referred to as “U.S. QIBs”), and (ii) Qualified Purchasers (“QPs”), as defined in Section 2(a)(51) of the Investment Company Act (persons who are both a U.S. QIB and a QP are referred to as “Entitled QPs”), pursuant to Rule 144A under the U.S. Securities Act and in accordance with Section 3(c)(7) of the Investment Company Act, and (b) to persons who are not U.S. Persons outside the United States, pursuant to Regulation S under the U.S. Securities Act and the applicable laws of the jurisdiction where those offers and sales are made. There will be no public offering of Equity Shares in the United States.

LISTING: The Equity Shares offered through the RHP are proposed to be listed on the Stock Exchanges. Our Company has received ‘in-principle’ approvals from BSE and NSE for the listing of the Equity Shares pursuant to their letters dated October 3, 2023. For the purpose of the Offer, the Designated Stock Exchange shall be NSE. A copy of the RHP has been filed in accordance with Section 32 of the Companies Act, 2013, and the Prospectus shall be filed with the RoC in accordance with the Companies Act, 2013. For details of the material contracts and documents available for inspection from the date of the RHP up to the Bid/Offer Closing Date, see “Material Contracts and Documents for Inspection” on page 656 of the RHP.

DISCLAIMER CLAUSE OF SECURITIES AND EXCHANGE BOARD OF INDIA (“SEBI”): SEBI only gives its observations on the offer documents and this does not constitute approval of either the Offer or the specified securities stated in the Offer Document. The investors are advised to refer to page 592 of the RHP for the full text of the disclaimer clause of SEBI.

DISCLAIMER CLAUSE OF RBI: The Company has a valid certificate of registration issued by the Reserve Bank of India dated March 13, 2023. However, the RBI does not accept any responsibility or guarantee about the present position as to the financial soundness of the Company or for the correctness of any of the statements or representations made or opinion expressed by the Company and for the repayment of deposits/discharge of liabilities by the Company.

DISCLAIMER CLAUSE OF SEBI: SEBI only gives its observations on the offer documents and this does not constitute approval of either the Offer or the specified securities stated in the Offer Document. The investors are advised to refer to page 592 of the RHP for the full text of the disclaimer clause of SEBI.

DISCLAIMER CLAUSE OF BSE: It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the Offer Document has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the Offer Document. The investors are advised to refer to the page 606 of the RHP for the full text of the disclaimer clause of BSE.

DISCLAIMER CLAUSE OF NSE (The Designated Stock Exchange): It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Offer Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Offer Document. The investors are advised to refer to page 607 of the RHP for the full text of the disclaimer clause of NSE.

For further details in relation to the Company, BRLMs, Company Secretary and Compliance Officer of the Company, availability of application forms, abridged prospectus and RHP, please refer to statutory advertisement published on XXX XX, 2023.