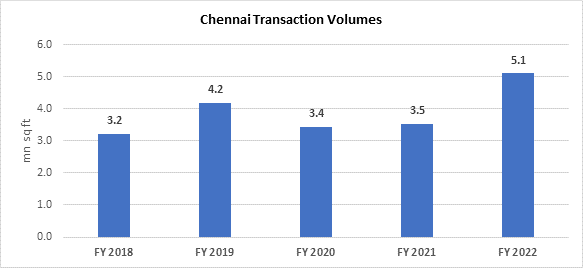

`Knight Frank India, an international property consultancy, in their latest report – ‘India Warehousing Market Report – 2022’, cited that Chennai recorded warehousing transaction volume of 5.1 mn sq ft in FY 2022, a substantial growth of 44% YoY compared to 3.53 mn sq ft in FY 2021.

Chennai, due to its proximity to the sea, became a desirable base for heavy industries-. Apart from serving as a home base to Automobile industry; textile production and manufacturers for heavy industries are among the other major industries driving the industrial and warehousing market in city.

WAREHOUSING TRANSACTIONS ACROSS TOP 8 INDIAN CITIES

| FY 2022 | % Change | CAGR | |

| City | in mn sq ft | FY 2022 YoY | FY 2017-22 |

| NCR | 9.1 | 32% | 26% |

| Mumbai | 8.6 | 48% | 41% |

| Pune | 7.5 | 166% | 30% |

| Bangalore | 5.9 | 38% | 36% |

| Hyderabad | 5.4 | 128% | 35% |

| Ahmedabad | 5.3 | 81% | 25% |

| Chennai | 5.1 | 44% | 22% |

| Kolkata | 4.3 | 41% | 26% |

| Total | 51.3 | 62% | 30% |

Source: Knight Frank Research

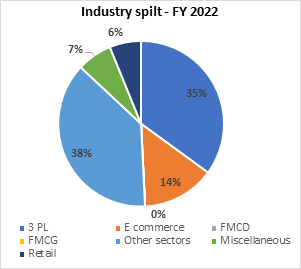

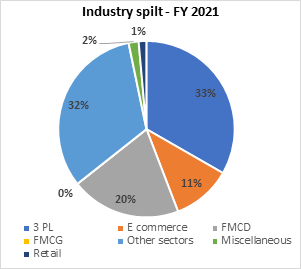

With respect to industry-split of transaction volume, manufacturing sectors (automobile, pharmaceutical, etc.) except FMCG and FMCD constituted to the biggest demand driver for warehouses. The sector accounted for 38% share of the region’s warehousing transactions, followed by Third Party Logistics (3PL) players with 35% share in FY 2022. E-commerce and retail players have been a recent addition to this list of warehousing demand drivers in the city. The retail sector witnessed significant increase in share of transaction volume from 1% in FY 2021 to 6% in FY 2022.

INDUSTRY-SPLIT OF TRANSACTION VOLUME

Source: Knight Frank Research

Notes:

Warehousing transactions data includes light manufacturing/assembling

Other Sectors – These include all manufacturing sectors (automobile, pharmaceutical, etc.) except FMCG and FMCD

Miscellaneous – These include services such as telecom, real estate, document management, agricultural warehousing and publishing

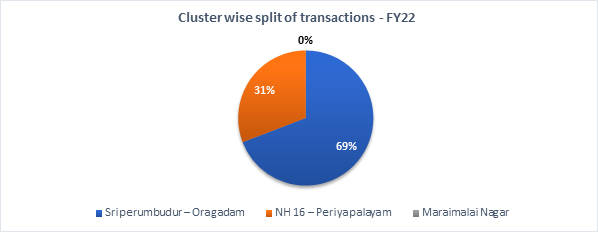

With respect to cluster split of transactions, the Sriperumbudur-Oragadam area dominated with the highest share of warehousing transactions. The region accounted for 69% of the total transacted volume during FY 2022. This cluster, which is well-known for manufacturing also serves as the main hub for the automotive and related industries.

Shishir Baijal, Chairman and Managing Director, Knight Frank India said, The high growth rate of organised warehousing sector in India is a result of its rising GDP and consumerism. With warehouse leasing in India surpassing the pre-pandemic level, the sector is poised to take a quantum leap to match its more mature peers around the world. This will be supported by the ever-increasing institutional interest in owning, developing, and operating warehouse assets ensuring professional expertise to direct the course of this growing market as it matures. In terms of investment, the warehousing sector has received private equity of US$ 1.2 Bn in H1 2022, as against US$ 1.3 Bn that the sector received in the entire year of 2021, adequately demonstrating the confidence global and Indian investors have on the sector’s future.”

Shishir further added, “Government’s push towards development of infrastructure and India’s new Logistics Policy will help in the surge. With the strong demand recorded in the secondary markets, the warehousing momentum is gaining shape even beyond the top 8 markets in the country and the development of Multi Modal Logistics Parks will further create more warehousing zones covering the geographic expanse of the country. ”

CHENNAI: LAND RATE AND RENTS

Both land rates and rentals witnessed appreciation in select pockets across the three major clusters in FY 2022. Driven by the increase in warehousing demand from e-commerce and 3PL companies, Grade A warehouse rents appreciated marginally across most micro-markets in the NH 16 / GNT Road – Periyapalayam cluster (North Chennai). Steady manufacturing activity contributed to a marginal increase in warehouse rents in both Sriperumbudur – Oragadam and GST Road – Maraimalai Nagar clusters. Increased warehousing traction also attributed to increase in land rates in Sriperumbudur, Irungattukottai, Red Hills and Karanodai belts.

In terms of rental value, rates for Grade A warehousing space in Oragadam loaction in the Sriperumbudur – Oragadam cluster recorded the rents in the range of INR 248 – 280 sq m/month, followed by Irungattukottai which recorded rent in the range of INR 237 – 269 /sq m/month.